How to Fix Annual Leave Balances in Xero Payroll

How to Fix Annual Leave Balances in Xero Payroll

I’ve come across many situations where annual leave balances in Xero Payroll are incorrect, or annual leave has been paid out at the incorrect rate. I’ve got very good at trouble shooting and retrospectively fixing these issues.

Errors are much more likely to happen for part time employees, or where standard hours have changed, or employees are on flexible or rostered hours. This is because annual leave in Xero Payroll is based on the standard hours in the employment tab which are more likely to change.

These are the most common errors I come across and below is how to fix them.

- Missing annual leave accruals

- Annual leave accruing on the wrong date

- Annual leave balance becoming incorrect when standard hours change

- Updated standard hours causing incorrect accruals

- Annual leave paid out incorrectly

- Incorrect opening balances

- Annual leave processed incorrectly

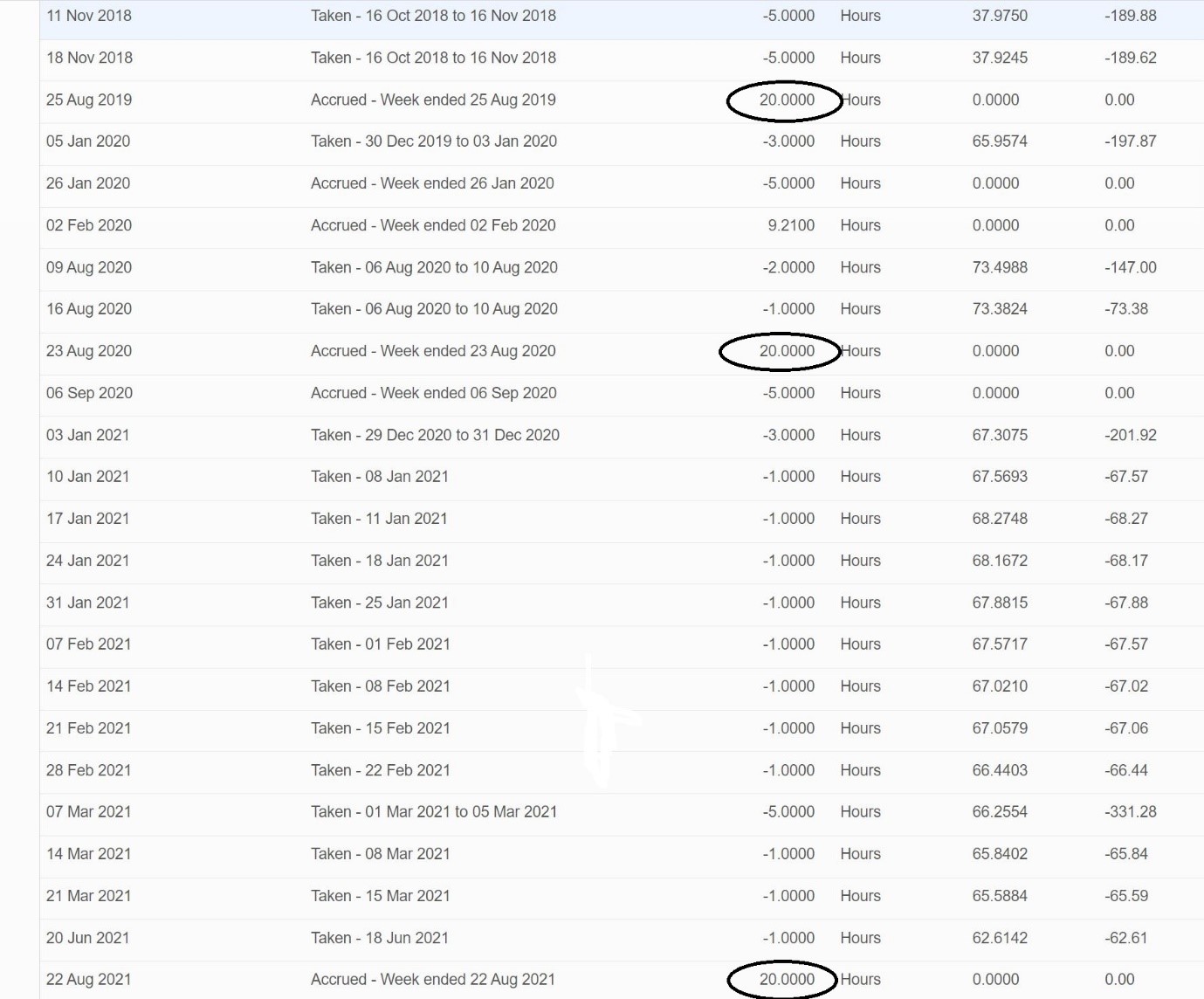

Check the leave transactions report to confirm that annual accruals have happened on the expected dates. You should see them every 12 months. You can see the annual leave accruals in the example below. Here, the employee had standard hours of 1 hour per day x 5 days per week even though they almost always worked a lot more than 5 hours a week.

There are at least 2 reason why annual leave might not accrue on an anniversary date.

1. Anniversary date must be included in a normal payrun

There needs to be a normal payrun which includes the anniversary date when annual leave is due to accrue.

If unscheduled payruns have been used instead of normal payruns, then the accruals will not occur. If you have been using unscheduled payruns then this should stop. Usually the reason unscheduled pay runs are being used instead of regular pay runs is because the pay run dates have got messed up. The way to fix this is to set up a new Pay Calendar for the next period you want to process a normal pay for and switch the employees to that calendar.

2. No standard hours in the employment tab (0 hours per day x 0 days per week).

No standard hours should only be used for truly casual employees. If your employee works variable part-time hours then for Xero Payroll to accrue annual leave you need to enter in minimum hours.

Whatever standard hours you enter in the employment tab with determine future annual leave accruals.

You can retrospectively add missing accruals using unscheduled pay runs backdated to the correct period so they show correctly in the leave transactions report. When you do this, also check the holiday pay balance because if annual leave has not accrued then holiday pay will also not reverse on those same anniversary dates.

TIP

The employee in the above example will have annual leave paid out at a higher rate than their standard rate

Annual leave accruing on the wrong date

Xero Payroll uses the employee start date to calculate anniversary dates and this can be problematic if the anniversary date needs to be based on a different date. Xero Payroll does not have the ability to record an anniversary date that is separate from the employees start date.

There are at least a couple of reasons why the anniversary date might need to change.

If the employee has taken a long period of unpaid leave then it might be appropriate to delay the anniversary date for the next annual leave accrual. There is information on the government employment website about this.

In this situation it might be appropriate to change the employee start date in Xero Payroll, to account for this delay. You will need to add a note in the employee record of the original contracted start date and why it has been changed.

Another reason is if an employee is changing from casual to permanent. When the employee was casual they may have been receiving 8% holiday pay with every pay. So when they change to permanent, their anniversary date would generally start from when they became permanent – otherwise they will effectively be paid again for the holiday pay already paid out.

In this situation it is best to terminate the employee as a casual in Xero Payroll and reload them as a new employee with a new start date for their new contract.

Annual leave balances becoming incorrect when standard hours change

If an employees standard hours change, and they have accrued annual leave, then a manual adjustment of the annual leave balance will most likely be needed. This is because Xero Payroll represents the annual leave balance of weeks / days with hours.

Here’s an example:

You have a part-time employee who works 20 hours a week for 2 years.

After 12 months and again at 24 months they accrue 4 weeks annual leave, represented in Xero Payroll by 80 + 80 = 160 hours.

They also take some leave during the two years and so have a balance of 1.5 weeks at the end of the 24 months represented by 30 hours.

Then after 2 years you give them a new full-time contract for 40 hours a week. At that point in time, they will still have 1.5 weeks annual leave showing in Xero Payroll represented by 30 hours.

However, the 30 hours now only represents 0.75 of their new standard week (40 hours x 0.75 = 30 hours).

At that point in time their correct balance should be 60 hours (40 hours x 1.5 weeks).

So a manual adjustment of +30 hours is required using an unscheduled pay run.

Any time contracted standard hours change, check the annual leave balance at that point in time, convert into weeks, and adjust to represent the new standard hours that make up the new standard week. I use a simple spreadsheet to do this.

Updated standard hours causing incorrect accruals

Sometimes standard hours in the employment tab get updated when an employee changes their work pattern, even though their contract hasn’t changed.

This will cause a different number of hours to accrue at the next anniversary based on the changed standard hours. It will then be unclear how many days/weeks are accrued because some annual leave may have accrued based on say 20 standard hours, while other accruals might be based on say 30 standard hours. It just doesn’t work.

If this happened in the past you will see different accruals in the leave transactions report, and changes in standard hours in the employment tab, but no adjustments.

The way to fix it is to:

- Check the contract and change the standard hours in the employment tab back to that.

- Find any accruals that have happened at an incorrect number of hours, and adjust with a backdated unscheduled pay run.

It’s also useful to check that any annual leave paid out was paid out at the correct rate. Even if a strange number of hours were paid out, as long as they were paid out at the correct rate it may not matter.

Where an employee has flexible or changing hours, Xero Payroll works best on minimum hours which will represent the weeks/days of annual leave in a consistent manner.

Annual leave paid out incorrectly

If an employee’s average weekly pay is higher than their standard weekly pay then when annual leave is paid out, the hourly rate paid should be higher than the standard rate.

If the employee has been doing overtime, has had regular bonuses or other extra payments, then in general their annual leave pay out $ rate should rise.

Xero Payroll will do this automatically but it can be manually changed back to the standard rate and this sometimes happens if the employer does not understand their obligations. Also, the rate that Xero Payroll automatically calculates might not be correct in all instances.

To correct this type of error first go through the leave transactions report, and for each time annual leave was paid out check whether the average rate was higher than the standard rate at that time.

- Option 1 – Work out the increased $ that should have been paid, and adjust by making a back pay.

- Option 2 – Work out how many hours should be been paid out and. adjust the balance of hours with an unscheduled pay run.

I then use a spreadsheet to work out the correction as in the example below.

Option 1 – adjust the $ value that should have been paid

This method involves backpay, but no adjustment to the number of AL hours the employee has. If they were short paid then the correction will be a cash payout.

• Run the gross earning report to calculate the average weekly earnings over previous 52 weeks from when AL was taken

• If the average is higher than the standard weekly earnings then:

• Calculate what the raised hourly rate should have been (gross weekly average divided by normal weekly hours)

• Check the $ amount that was paid out for Annual Leave on the Leave Transactions Report

• Calculate the $ amount that should have been paid out – this will be a higher than recorded in the Leave Transactions report.

• Calculate the difference between the amount paid out, and the amount that should have been paid out.

• Run an unscheduled pay run with a one off back pay and add a note for reference.

Option 2 – adjust number of leave hours paid

This method involves no backpay, but adjusting the number of AL hours the employee has. If they were short paid then the correction will increase their number of leave hours.

• Run the gross earning report to calculate the average weekly earnings over previous 52 weeks from when AL was taken

• If the average is higher than the standard weekly earnings then calculate what the raised hourly rate should have been (gross weekly average divided by normal weekly hours)

• Check the $ amount that was paid out for Annual Leave on the Leave Transactions Report

• Calculate how many hours leave should have been paid out – this will be a lower number than recorded in the Leave Transactions report.

• Calculate the difference between the number of hours recorded, and the number of hours that should have been recorded.

• Run an unscheduled pay run to add back in the additional hours.

Sometimes opening balances are used to adjust an annual leave balance but I don’t generally recommend this. My view is that opening balances should only show balances brought forward from another system when moving to Xero Payroll and that those balances would never change. I would make any other adjustments using unscheduled pay runs.

If opening balances have been used to make adjustments then to unwind that you will need to determine what the correct opening balances should have been, update them and process any other adjustments with unscheduled payruns.

When entering opening balances make sure the accrued annual leave balance is separated from the holiday pay $ balance. Ensure you understand the balances being exported from the previous system and how that system refers to annual leave versus holiday pay. There might be different terminology used such as “current year accrual” which is actually holiday pay.

If a combined balance of holiday pay and annual leave is entered as an opening annual leave balance in Xero Payroll, the employee will be overpaid in annual leave because the holiday pay will be duplicated.

Annual leave processed incorrectly

If annual leave pay outs are not showing on the leave transactions report this may mean they were processed incorrectly such as being processed as a new type of ordinary hours.

To correct this, the ordinary hours can be reversed and in the same pay run the annual leave applied for and approved. As long as the annual leave should have been paid at the normal rate (and no increased $ rate was due) then the net effect will be nil $. Otherwise an adjustment to the annual leave hours will also be required or a backpay due. Here's an example of how the Unscheduled pay run might look: