Negative Holiday Pay Balances in Xero Payroll

Negative Holiday Pay Balances in Xero Payroll

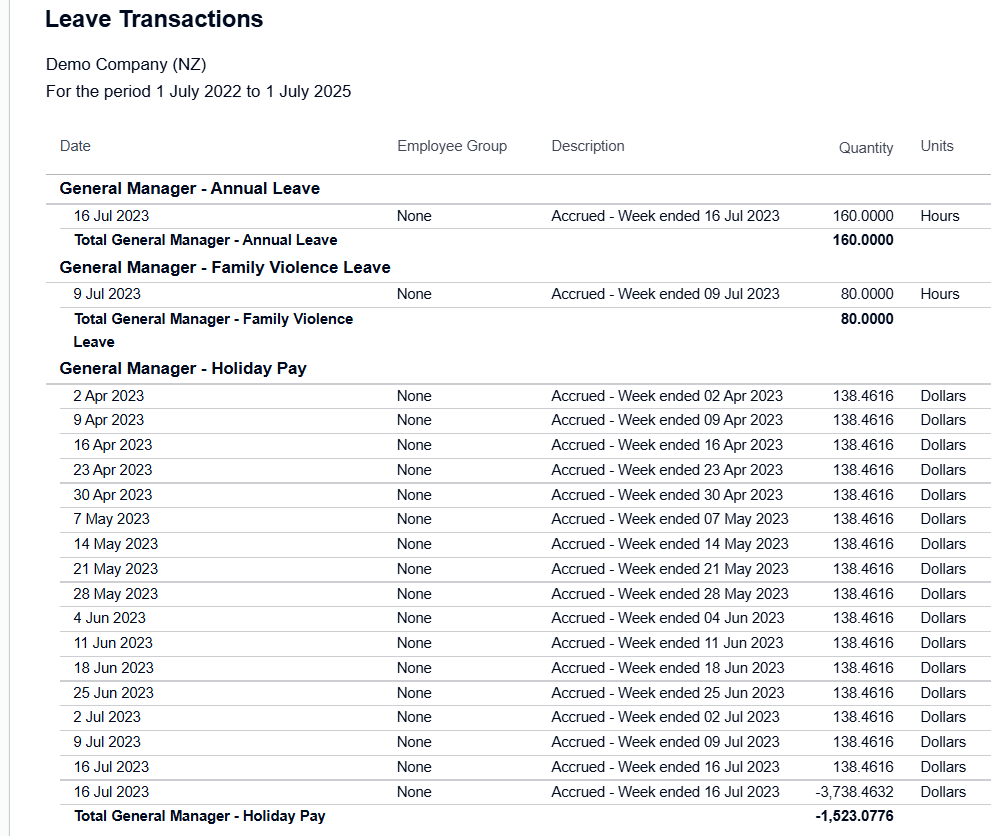

Holiday Pay in Xero Payroll NZ is 8% of gross earnings since the last Annual Leave anniversary so should always be a positive number. If the balance is showing as a negative number (as seen on the Leave Transactions Report) then there is likely an error.

There are rare exceptions to this which I am not addressing in this blog.

The error is generally caused by the automatic Holiday Pay reversal on the Annual Leave anniversary date.

Holiday Pay should reverse back to Nil, at the same time as 4 weeks Annual Leave accrues.

What causes a negative balance?

Xero uses Gross Earnings since the last anniversary x 8% from the Gross Earnings Report to calculate the amount of the Holiday Pay Reversal. Then this reversal amount appears on the Leave Transaction Report.

If the reversal amount from Gross Earnings Report is not the same as the total of Holiday Pay in the Leave Transactions Report, then the Holiday Pay balance will not revert back to Nil and will show incorrectly – it could be a negative, or just the wrong amount.

What you need to know:

Total Gros Earnings since last Anniversary x 0.08% (as shown on Gross Earnings Report)

Should =

Holiday Pay Total (as shown on Leave Transactions Report)

A Holiday Pay Opening Balance only appears on the Leave Transactions Report – it does not count towards Gross Earnings, does not appear on the Gross Earnings report and is not part of the Holiday Pay reversal calculation.

Earnings from payruns in Xero Payroll as well as earnings entered into the Past Earnings tab contribute to the Gross Earnings Report, and are used to calculate the amount of the Holiday Pay Reversal.

Why would these totals be different?

It might be the Holiday Pay Opening Balance in the Employee Leave Tab. An Opening Balance is used if some of the gross earnings since the last anniversary are not in Xero Payroll – ie. They were in another payroll system, or missing for some other reason.

If an Opening Balance is missing, then the Holiday Pay in the Leave Transactions Report is going to be too low and won’t match 8% of Gross Earnings for the same period. If these don’t match then the reversal will not take the Holiday Pay back to nil.

Example: General Manager

Start date of employment 14 July 2022.

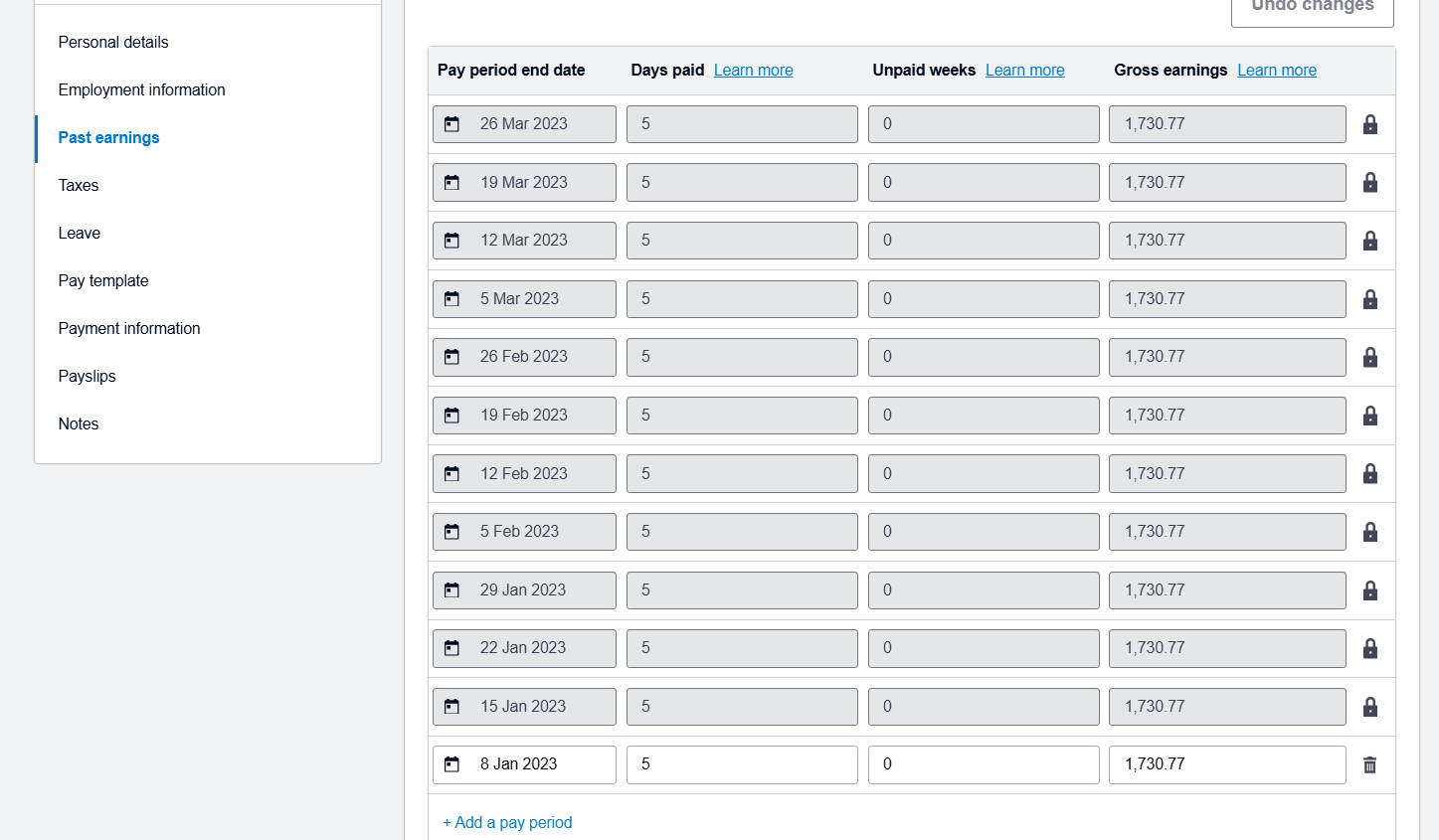

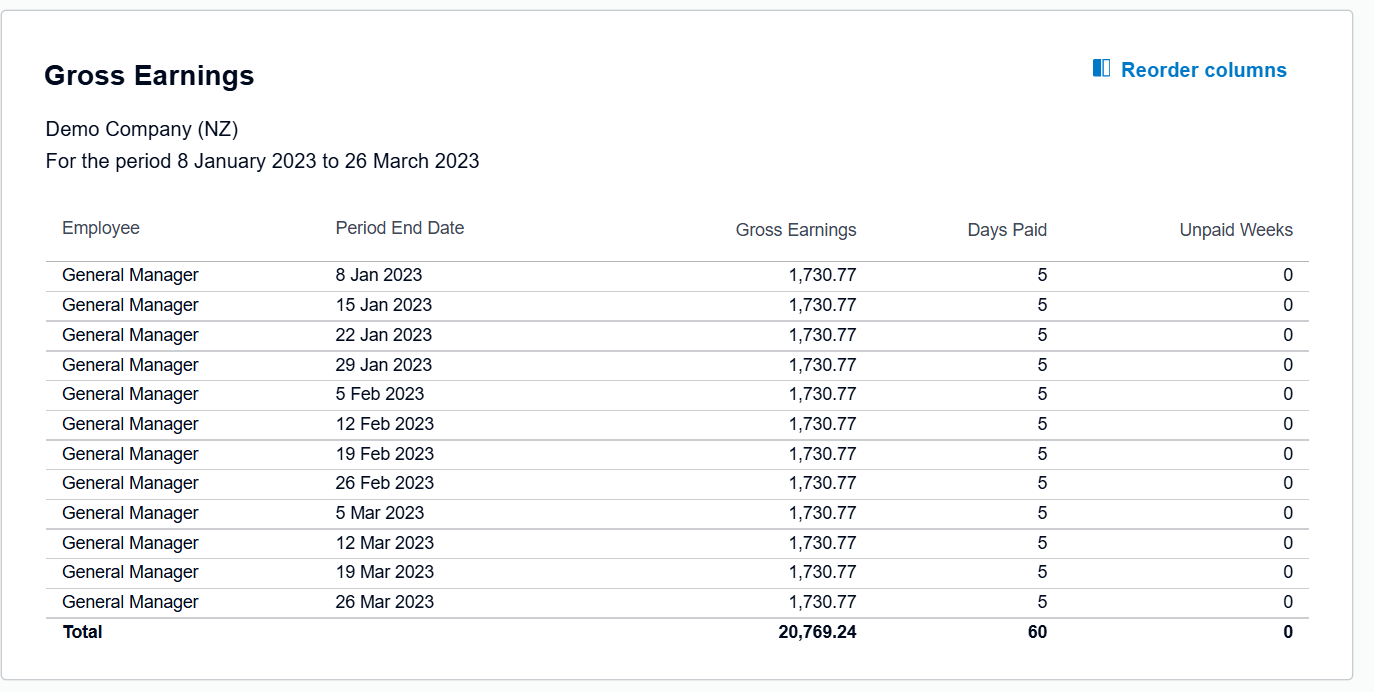

Past Earnings: 8 Jan – 26 Mar 2023: $20,769.24 as shown here:

1st pay in Xero, 2 April 2023

Gross Earnings from Payruns 2 April 9 July: $25,961.55

Total Gross Earnings – 8 Jan – 14 July $46,730.25 including from Past Earnings entries.

When Xero Payroll reverses the Holiday Pay balance, it calculates based on the Gross Earnings report which includes any Past Earnings entered. Even though Xero Payroll may have the information in Past Earnings to calculate what the Opening Balance for Holiday Pay is, it doesn’t do this automatically. You have to calculate the Holiday Pay Opening Balance amount and enter it.

Here’s what it looks like with no opening balance, causing a negative Holiday Pay balance.

In this example the Reversal calculation of $3738.42 (8% of gross earnings on gross earnings report) includes entries on Gross Earnings report from 8 Jan – 9 Jul 2023. April – Jul payslips + Past Earnings for Jan - April.

The correct balance after reversal should be $138.4616 – holiday pay on 14 April 2023 pay.

An opening balance of $1661.5392 is needed, to match 8% of $20,769.24. (8 Jan -26 Mar Gross Earnings).

Here it is showing correctly.

The Opening Balance has to be whatever matches Xero’s record for Past Earnings – up to the previous anniversary date.

If Past Earnings were not entered or partially entered, the Holiday Pay Opening Balance must match that – either a partial amount or no opening balance at all.

How to fix it

Good news is, Holiday Pay balance errors are easily fixed. With Holiday Pay, only earnings since the last anniversary are relevant as everything before that would be reversed back to Nil. Calculate what the correct Holiday Pay should be by calculating gross earnings since last anniversary x 8%. (run a Gross Earnings report).

Either run an Unscheduled PayRun to make an adjustment, or enter in an opening balance to make the Holiday Pay current balance correct. Unless it’s clear what the opening balance should be, I prefer to do an adjustment in an Unscheduled PayRun with an explanation. Opening balances can be changed at any time, by anyone with Payroll Admin permission. An unscheduled payrun is less easy to change.