Court Fines in Xero Payroll

Court Fines in Xero Payroll

It is not uncommon to find a business thinks they have been paying court fines on behalf of their employees, and then find out actually the payment is not included in the batch downloaded.. This is because the method Xero Payroll explains in Xero Central does not include the payment in a way you might expect.

There is an alternative method to manage Court Fines in Xero Payroll which ensures payments are included with the batch but doesn't have some of the features offered by listing it as a Statutory Deduction.

Both methods are outlined below with pros and cons, and showing the differences of how the Court Fine appear on various reports from Xero Payroll.

At the end of the blog I have given a screen shot to also show how Court Fines are not included in the Xero Payroll payments to IRD - for both Method 1 and Method 2.

Which method is recommended?

That depends on your business .

Method 1 might suit if it's important to not have to keep track of protected income and balances separately, and you are comfortable with ensuring there is a separate payment made for all court fines -outside the normal batch downloaded from Xero Payroll. This method may suit if your bookkeeper always fully balances the payments reports.

Method 2 might suit if it's important to have all the payments included in the batch you download from Xero Payroll, and not to have to make manual payments separately. Also if you are comfortable relying on the Court to advise when fines have been paid off, or happy to keep track of this manually.

Method 1 - Adding a Court Fine as a Statutory Deduction

Xero Central outlines how Court fines in Xero Payroll can be added to an employee template as a Statutory Deduction.

- Entered into Employee Template

- Outstanding balance kept by Xero Payroll

- Other details including reference numbers, protected pay also kept by Xero Payroll

- Court Fines show on the Payslip alongside other Statutory Deductions such as Child Support, Kiwisaver and Student Loans

- Court Fines will not be included in the batch downloaded from Xero Payroll for uploading to the bank.

- Court Fines are not included in the Taxes and Filing net amount being paid to IRD along with PAYE.

- Court Fines do not show on the Pay Summary Report and no indication it is treated differently to Child Support, Kiwisaver, and Student Loans.

Payments can be missed because they are not in the batch produced by Xero Payroll, and they are not in the net payment showing in Taxes and Filing for payment to IRD.

In my view this is surprising because Court Fines are listed alongside Child Support and Student Loan Payments, which are automatically included with PAYE IRD payments.

Here are some screen shots to clarify. Please bear in mind these are only demos, and all the information on the reports might not be consistent - I've just produced them to make the point. e.g. dates / number of employees and payment amount might not be consistent.

Method 1 - Statutory Deduction - Pay Template

This is how the Pay Template looks if you add a Statutory Deduction as detailed by Xero Central. You can see the $50.00 payment shows including the balance owing, protected net earnings and the balance owing.

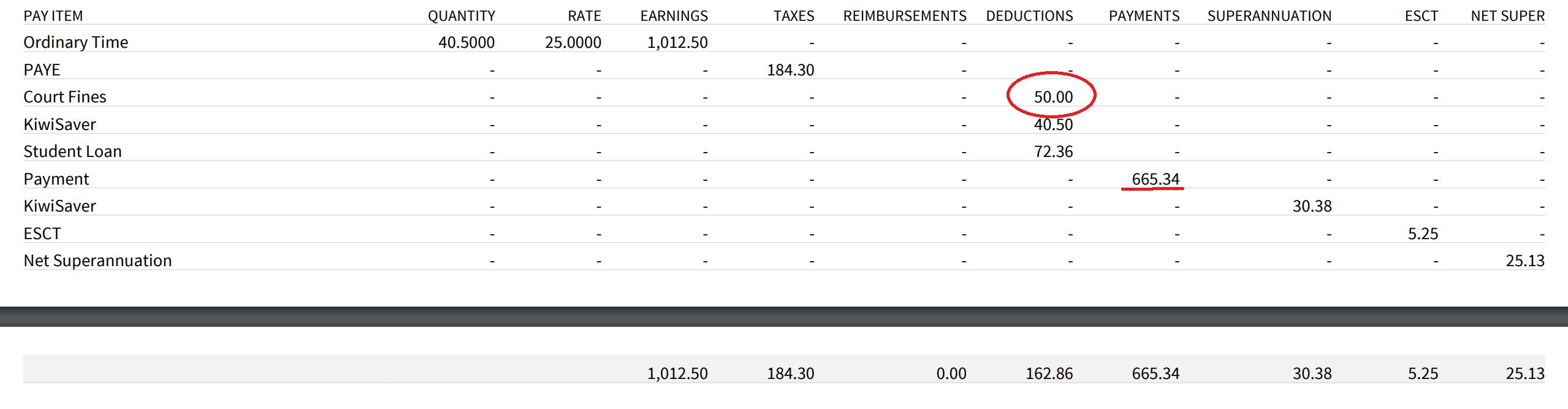

Method 1 - Statutory Deduction - PaySlip

This is what the payslip will look like. You can see the $50.00 court fine appearing under Statutory Deductions along with Kiwisaver and Student Loan. You can also see the $50,00 is not listed as a Payment, only the net amount due to the employee is showing of $665.34.

Method 1 - Statutory Deduction - Payment Report

Consistent with the PaySlip, there is no mention of the $50 court fine in the payments report - only the net payment due to the employee of $665.34. The $50 will not be included in the batch file downloaded from Xero Payroll.

Method 1 - Statutory Deduction - Pay Summary Report

In this view you can see the $50 Court Fine listed as the deduction along side other Statutory Deductions like Kiwisaver and Student Loan payments. The only payment listed is the net payment to the employee of $665.34.

This $50 showing as a statutory deduction has to be loaded separately and manually as a payment to the court. It will not be included in the normal batch payment downloaded from Xero Payroll - only items in the PAYMENTS column are included in that batch.

Method 2 - Adding a Court Fine as a Second Bank Payment

The second option is to completely ignore the Xero Payroll feature and instead add the Court Fine Payment to the employee record as a second Bank Payment. The same way you might add a second payment to go to a charity each payrun, or a savings account, or rent, or anything else.

- The payment is added to the employee Payments tab and does not appear on the employee Pay Template

- The payment shows on the payslip as a payment, not under statutory deductions.

- The Xero Payroll batch payment will include the Court Fine.

- The Payments Report will include the Court Fine.

- The Pay Summary Report will include the Court Fine in the payments section, not listed as a statutory deduction.

- You need to keep track of the running balance manually and remove the payment information when the debt is paid.

Method 2 - Second Bank Payment - Payment Information Tab

There is no change to the Pay Template if using Method 2. Instead the Court Fine is entered in the Employee Payment Information tab, adding the IRD account number as a second account number to make a regular payment to. In this example below I have not entered the details, just showing where the section is.

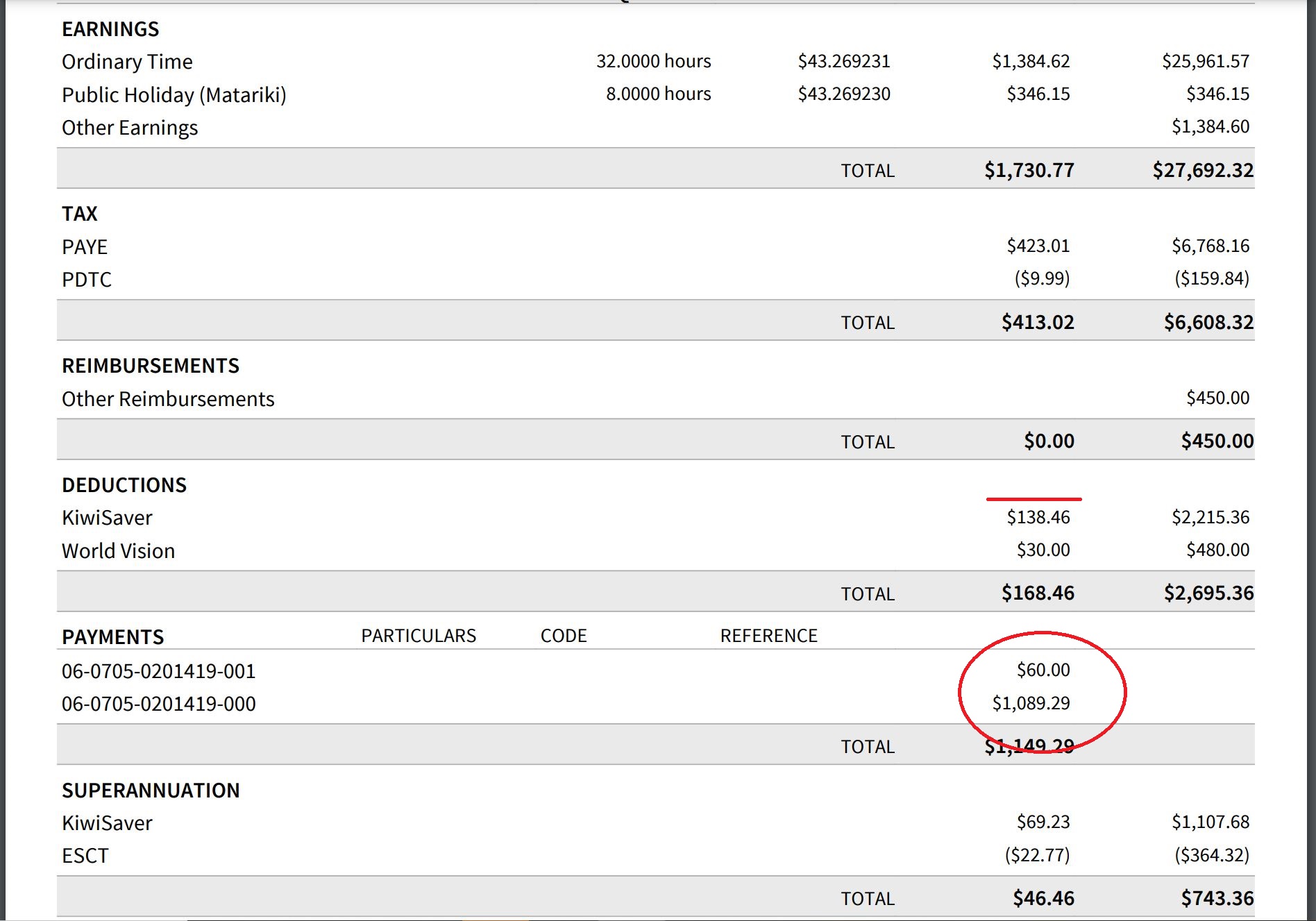

Method 2 - Second Bank Payment - Payslip

With this method the Court Fine will be seen in the Payments Section, alongside the net payment being made to the employee. This example is from the demo file so the bank accounts are for demo only. Normally it would be the IRD number as advised by IRD. With this method, the Court Fine will not show under Deductions - in this example with Kiwisaver and World Vision.

Method 2 - Second Bank Payment - Payment Report

With this method the payments will mirror the payslip - both the net pay and the Court Fine as showing in the Payments Report. The Court Fine will also be included in the batch file downloaded from Xero Payroll.

Method 2 - Second Bank Payment - Pay Summary Report

In this view you can see the $60 Court Fine listed as a payment along side other net payment to be made to the employee. It's a payment and will be included in batches.

Taxes and Filing

The Taxes and Filing Summary in Xero Payroll does not include Court Fines or any other Statutory Deductions besides Child Support, Kiwisaver, and Student Loans. Court Fines or other Statutory Deductions are not included in the amounts Xero Payroll show as due to IRD.

If you would like help with Court Fines in Xero Payroll, then get in touch. We would love to hear from you.